The Wallace Insurance Agency - The Facts

Table of ContentsRumored Buzz on The Wallace Insurance AgencyThe Wallace Insurance Agency - QuestionsThe Only Guide to The Wallace Insurance AgencyAll About The Wallace Insurance AgencySome Known Questions About The Wallace Insurance Agency.

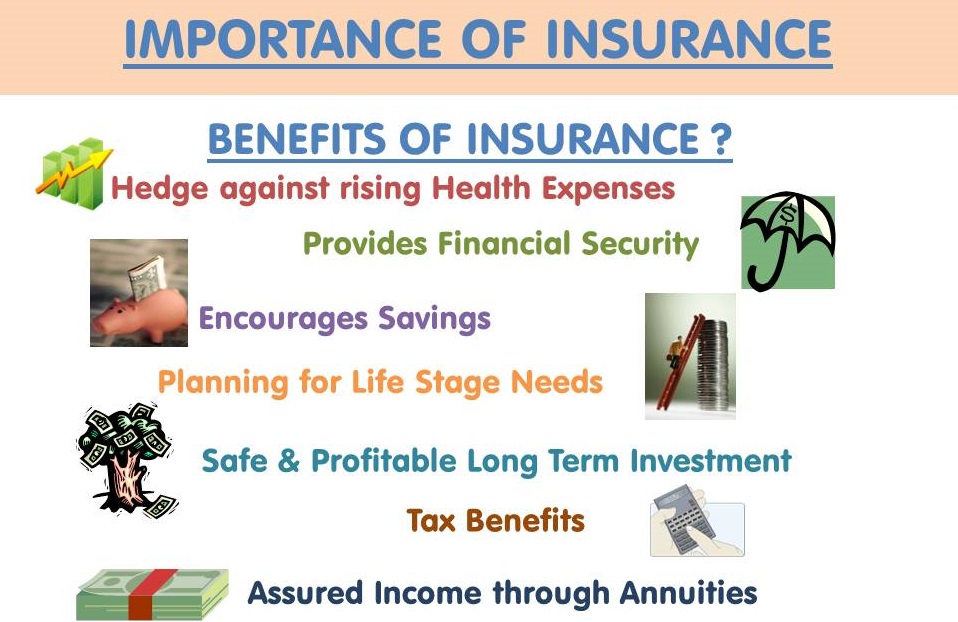

You get totally free preventive treatment, like injections, screenings, and some check-ups, even prior to you fulfill your insurance deductible. If you have an Industry plan or other qualifying health and wellness coverage through the strategy year 2018, you don't need to pay the charge that people without coverage have to pay.There is no refuting that you will have better assurance if you understand that you and your loved ones are monetarily safe and secure from various unexpected circumstances. Uncertainties in life can chop up at any moment, such as an unfortunate fatality or a clinical emergency. These circumstances also consist of an accident or damages to your car, property, etc.

You might need to dip right into your cost savings or your household's hard-earned money.

Not known Details About The Wallace Insurance Agency

The household can likewise repay any type of debts like home loans or various other financial obligations which the person guaranteed might have sustained in his/her lifetime Insurance coverage plans will help your family maintain their standard of life in situation you are not about in the future (Life insurance). This will certainly help them cover the costs of running the home via the insurance policy round figure payment

They will make certain that your youngsters are financially secured while seeking their dreams and aspirations with no compromises, even when you are not around Lots of insurance plans feature cost savings and financial investment schemes together with normal protection. These assistance in building wealth/savings for the future through normal investments. You pay costs on a regular basis and a portion of the exact same goes towards life coverage while the various other section goes in the direction of either a cost savings plan or financial investment strategy, whichever you choose based on your future goals and needs Insurance aids secure your home in the occasion of any type of unanticipated calamity or damage.

If you have coverage for valuables and products inside the home, then you can buy substitute things with the insurance policy cash One of the most crucial benefits of life insurance coverage is that it enables you to conserve and grow your money. You can use this total up to meet your lasting objectives, like purchasing a home, starting a venture, conserving for your child's education and learning or wedding event, and more Life insurance policy can enable you to stay financially independent even during your retired life.

The Best Strategy To Use For The Wallace Insurance Agency

They are low-risk plans that aid you maintain your existing way of living, fulfill medical expenditures and fulfill your post-retirement goals Life insurance coverage aids you plan for the future, while aiding you conserve tax obligation * in the here and now. The costs paid under the policy are permitted as tax * reductions of as much as 1.

You can save as much as 46,800/- in taxes * each year. Further, the quantities obtained under the plan are likewise excluded * subject to problems under Section 10(10D) of the Revenue Tax Act, 1961. COMP/DOC/Jan/ 2023/41/1904 There are a number of kinds of insurance coverage plans readily available. Some of the generally preferred ones consist of the following: Life insurance policy is what you can make use in order to secure your household in situation of your fatality during the tone of the plan.

Life insurance policy assists secure your household economically with a round figure quantity that is paid out in the occasion of the policy holder's death within the plan duration This is bought for covering clinical expenses revolving around numerous health issues, consisting of hospitalisation, therapies and so on. These insurance prepares can be found in convenient in case of medical emergencies; you can likewise get of cashless facility across network health centers of the insurance provider COMP/DOC/Sep/ 2019/99/2691.

5 Easy Facts About The Wallace Insurance Agency Shown

When you purchase insurance, you'll obtain an insurance coverage, which is a lawful contract between you and your insurance policy service provider. And when you suffer a loss that's covered by your plan and submit a claim, insurance policy pays you or a marked recipient, called a recipient, based upon the regards to your policy.

No one wants something negative to occur to them. Suffering a loss without insurance coverage can put you in a difficult economic scenario. Insurance coverage is an important financial tool. It can help you live life with less worries recognizing you'll receive financial help after a catastrophe or accident, aiding you recover much faster.

Some Known Details About The Wallace Insurance Agency

For car insurance, it could imply you have additional cash to help pay for repair work or a replacement vehicle after an accident - https://wallaceagency1.bandcamp.com/album/the-wallace-insurance-agency. Insurance coverage can aid keep your life on the right track, visit homepage as high as feasible, after something poor thwarts it. Your independent insurance representative is a great resource to read more concerning the advantages of insurance, as well as the advantages in your details insurance coverage policy

And in some cases, like automobile insurance and workers' payment, you may be required by law to have insurance policy in order to secure others. Learn concerning our, Insurance coverage options Insurance coverage is basically a massive nest egg shared by lots of people (called insurance holders) and handled by an insurance service provider. The insurance provider makes use of money gathered (called premium) from its insurance policy holders and other financial investments to pay for its operations and to fulfill its pledge to insurance holders when they file a claim.